Architecture should speak of its time and place, but yearn for timelessness

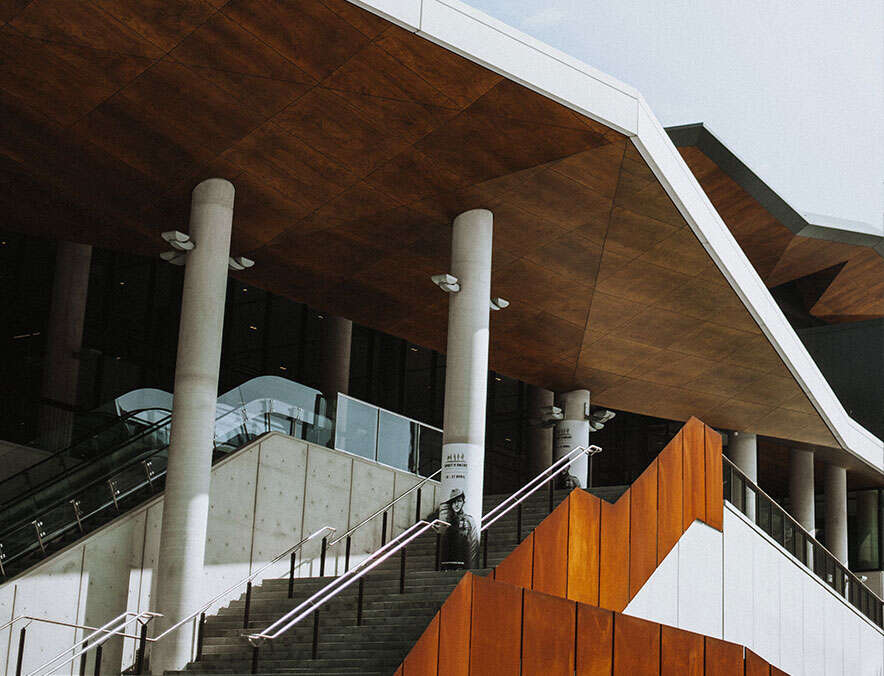

Design

We allow beautiful design to unfold as a reflection of a project’s unique vision, desires, and place in the landscape.

Landscape

We believe that the best innovative landscape architecture is a blend of both art and science, with a touch of wild.

Urban Planning

We are a collective dedicated to creating enriched urban environments that enhance the lives of people.

Sustainability

Sustainable design principles, including energy-efficient strategies, passive daylighting, and intelligent materials.

Research

As a young and energetic collaborative, Alder is simultaneously an academic think tank, and technological firm.

Commercial

We are an award-winning and licensed architecture practice that welcomes residential and commercial projects.